NEWS & VIEWS

Last year, FSL conducted research amongst its customers to understand client needs and identify key areas for development. One of these areas was the What-If module. The CGiX What-If module offers a Front Office solution for direct access to clients’ tax reports and future liability analysis. The analysis tool enables investment managers to consider accurate capital gains tax (CGT) implications as part of their modelling and asset allocation processes. Using this functionality can add value to the service provided to clients with suggestions and decisions being reinforced by tax benefits. With input from our customers, we have re-engineered the module and it is now ready for release with new upgrades from June 2020.

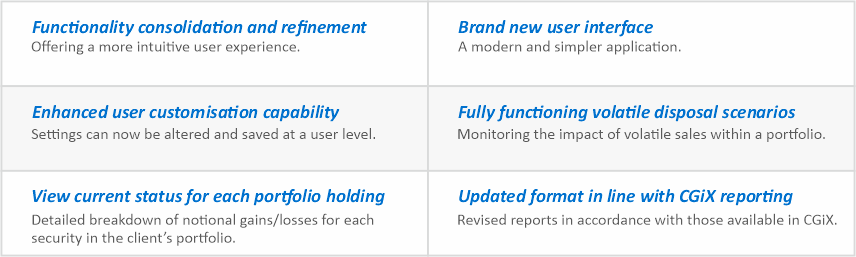

The updates

The module also comes with built in help sheets to assist the user in navigating the new features and working through particular client needs such as how to look up all clients that hold a particular security, to decide what to do if there is a ‘Sell’ recommendation concerning that instrument, and the most optimal way to liquidate an amount of money from a client’s portfolio or to minimise that client’s CGT liability in the current tax year.

The updated ‘scenario modelling’ function also allows the re-use of a scenario on multiple clients and occasions.

If you would like to learn more about the new CGiX What-If module and see a demo, please contact info@financialsoftware.co.uk