NEWS & VIEWS

Donald Trump officially became the 47th president of the United States following his inauguration at The Capitol building in Washington DC on Monday. It is the second time that Trump has taken office, having served as president before Joe Biden in 2017.

With the new US administration now in place, what tax changes can we expect over the next four years?

Income tax

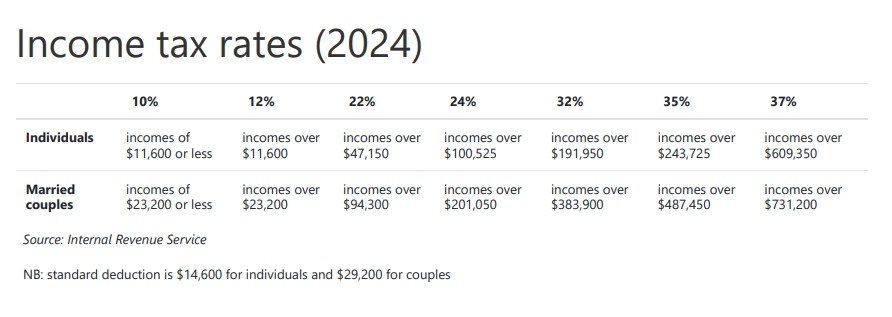

At the end of 2017, the US government introduced the Tax Cuts and Jobs Act (TCJA). It was a major overhaul of the US tax code, affecting individual taxpayers and business owners alike, and lowered the top marginal income tax rate to 37%.

For the 2018 tax year, the top rate rate applied for individuals earning over $500,000 and for jointly filing married couples earning over $600,000 for the 2018.

Prior to the act, the top marginal tax rate was 39.6% for individuals earning over $426,700 and jointly filing married couples earning over $480,050.

A significant portion of the TCJA is set to expire at the end of 2025, including the lowered income tax rates for individuals and married couples. However, it is looking unlikely that this will happen as President Trump promised to extend the act during his election campaign. Some have suggested that the new administration could even reduce the rates for income tax further.

The Tax Policy Center has suggested that about 75% of US households would get a tax cut with a TCJA extension. However, according to The Congressional Budget Office, a non-partisan federal agency, extending the expiring TCJA provisions for the next ten years would increase the national debt by $4.6 trillion.

As of 4 November, 2024, the gross US national debt figure stood at $35.95 trillion, according to the latest figures from the House Budget Committee.

Corporate income tax

The new administration has expressed support for dropping the current 21% corporate income tax rate – as established by the 2017 TCJA – to 20%. President Trump has also voiced support for the rate to drop further for corporations that make their products in the US.

The president has suggested the rate should be 15% for these companies to incentivize domestic production and potentially bring manufacturing jobs back to the US. The Tax Foundation estimate that the proposals would reduce federal revenue by about $460 billion over 10 years. The non-partisan think tank also noted that the measure could help generate GDP growth in the US in the long-term and could make the US a more attractive place for business investment.

For imported products, Trump has suggested a universal baseline tariff of at least 10% to 20% on all US imports. A higher 60% tariff has been floated for goods imported from China. In comments to reporters in the Oval Office on Monday, following his inauguration, Trump also suggested tariffs of up to 25% on imports from Canada and Mexico.

Capital gains tax

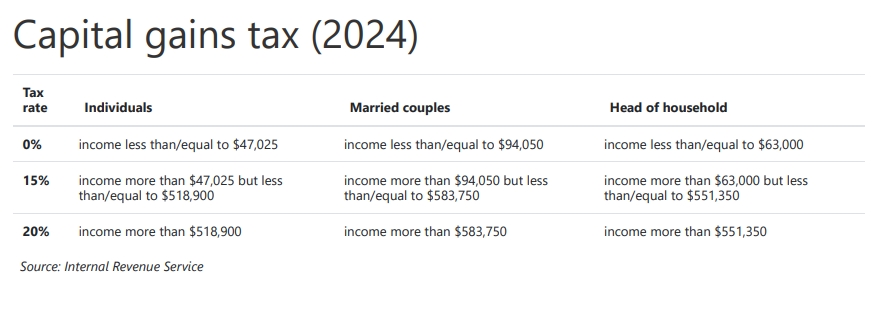

President Trump did not put forward any new proposals for capital gains tax (CGT) in the lead up to the US general election, but it is expected that the new administration will make the changes made to CGT, as part of the 2017 TCJA, permanent.

Currently, the tax rates for long-term capital gains in the US are 0%, 15% and 20%. These rates have their own brackets and are not tied to an individual’s ordinary-income tax bracket. The top CGT rate of 20% applies to individuals with a taxable income of over $518,900 and for jointly filing married couples with a taxable income of over $583,750.

Prior to the TCJA, CGT rates were tied to the investor’s ordinary income tax bracket. This meant that individuals which fell within the maximum 39.6% ordinary income tax bracket were taxed at the maximum 20% rate for long-term capital gains.

In 2017, the 39.6% income tax rate applied to individuals earning $418,400 and higher.

Project 2025 – a set of policy proposals written by the conversative think tank the Heritage Foundation and a number of Trump’s former Cabinet secretaries – has proposed a top long-term CGT rate of 15%.

President Trump has said he has had “nothing to do” with Project 2025, but many of the policy proposals have been popular with US Republicans and the think tank has a long history of influencing Republican initiatives. According to polling by YouGov in the lead up to the US general election, 26% of Republicans had a favourable view of the policy blueprint.

Tackling tax changes with FSL

With several potential tax changes on the horizon in the US, it is important for wealth managers and advisers to stay informed and keep pace with the changes as they unfold.

By having the right tools and resources in place, firms can quickly and confidently respond to legislative changes and their clients’ evolving needs. At FSL, we support wealth managers and their clients accurately calculate their taxable wealth with our award-winning solutions and services.