NEWS & VIEWS

On 22 March HMRC published Agent Update 106, for agents such as accountants who act on behalf of taxpayers. Agent Update 106 states that SA108 – the individual Self Assessment return form for capital gains – will be amended to include gains arising on the disposal of excluded indexed securities. This update was announced under the section regarding Qualifying Asset Holding Companies (QAHCs). It says that all such gains must be included in the self-assessment return, even those which were made outside a QAHC.

Changes to the tax return

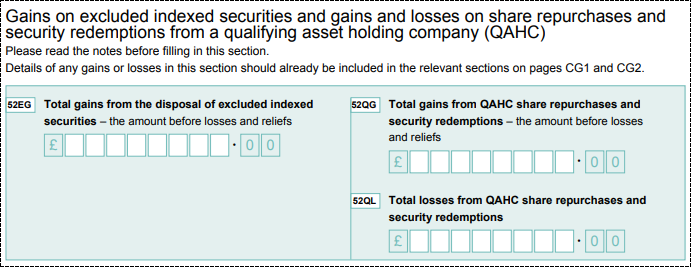

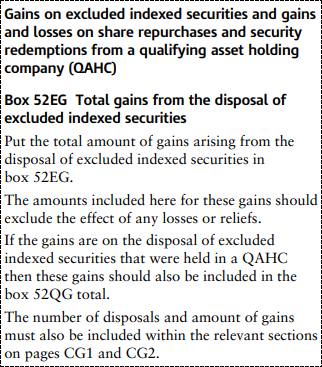

Page CG 4 will include a new section on the tax return and the accompanying notes:

What is an Excluded Indexed Security?

An excluded indexed security is a type of product where the amount payable on redemption depends upon the change in value of a chargeable asset or assets, or in an index of the value of a chargeable asset or assets. The retail prices index or a similar index is not an index for the purpose of classifying an excluded indexed security. An index of the FTSE 100 would be an index for this purpose, however.

Take a look at HMRC manual SAIM3050 for further details.

Updates to CGiX

CGiX does not currently have excluded indexed securities as a distinct asset classification. For our clients who receive our securities data via the Replicator, we tend to classify these assets as ‘Corporate Bonds’ within CGiX, following industry practice, because for tax purposes they are treated the same way: They are relevant securities, any gain on disposal is charged to capital gains tax, while any loss on disposal is an allowable capital loss.

FSL are working to add a new classification to CGiX for excluded indexed securities. For those clients who take our securities data we will carry out an exercise to review and reclassify any affected securities. You may receive queries from your clients regarding the new tax return box as they will need to report their gains on excluded indexed securities accurately.

The FSL team will make appropriate changes to CGiX and provide an update shortly. For any questions or further assistance, contact our team.