NEWS & VIEWS

Tax Talk is a regular series written by FSL’s tax expert, Alex Ranahan. Alex has nearly ten years’ experience as a tax adviser and analyst. He is accredited by The Association of Taxation Technicians and was recently elected co-chair of the Tax Committee for The Investing and Saving Alliance.

Alex’s Tax Talks are on general topics and are not tax or financial advice. If you are unsure of the tax treatment of a transaction, we encourage you to seek the appropriate tax advice.

How many drafts of this blog were tossed? Too many. These have been two of the most significant, eventful months of recent history, and there are still more developments to come.

At the time of writing, Rishi Sunak has been appointed leader of the Conservative Party and the new Prime Minister of the UK after Liz Truss’ resignation. The Conservative Party is the largest party in the UK and forms its government with Jeremy Hunt as its fourth chancellor during 2022. By the time this blog is published, we may have a new chancellor and even a general election in the works.

It seems pointless to write about tax consequences of the various fiscal events and budgets – I refuse to call a document setting out £60bn of spending increases and £45bn of tax cuts a ‘mini’ anything. We will have another budget(!) on 31 October, so let’s wait for that to take place before we get into any serious analysis. So, in this blog I’m instead going to talk about something else that interests me: tax relief.

The cost of living crisis

There is a terrible and worsening cost of living crisis going on in the UK. Inflation for September 2022 – the basis for the annual uplift to social security benefits in April 2023 – was announced to be 10.1%, the highest it has been in 40 years, and food prices rose by 14.6%. The Bank of England has increased the base interest rate to 2.25%, the highest in 14 years.

Amid all this, as people look for ways to save money, a common question I am asked is “are there any ways of saving money from tax?”

It is trivially true to say that the more tax you pay, the more tax you can potentially save. A common complaint against any government tax-cutting measure is that the richest tend to save the most but, realistically, that is always going to be the case. Indeed, one reason why high headline rates of tax do not necessarily deter investment is that where they are accompanied by tax reliefs for certain behaviours, they become more valuable. Does it matter that your company’s profits will be taxed at 25% rather than 19% if you can reduce your profits by the same amount by making targeted investments that will benefit your business? So, it is true of individual tax too.

Tax relief for individuals

The most common forms of tax relief available to individuals are via pension contributions and charitable donations. The way they work is by increasing your basic rate band of tax (charged at 20% income tax) or higher rate band (charged at 40%) by the ‘gross’ amount of the payment – that is, assuming that you have made the payment after tax and therefore the pension scheme or charity needs to claim the tax already paid on it back from HMRC.

For example, if you were to pay £100 into your personal pension pot, the pension scheme would assume that 20% income tax had already been taken from it. In other words, that £100 represents 80% of what you meant to put in your pension pot. So, the pension scheme calculates what that 20% should be and then goes to HMRC to ask for it to be paid in:

20⁄80×£100=£25 tax relief

Your basic rate band is increased by the ‘gross’ contribution, or 100% of the amount you meant to pay in:

100⁄80×£100=£125 gross contribution

This extension of the basic and higher rate bands gives the taxpayer relief.

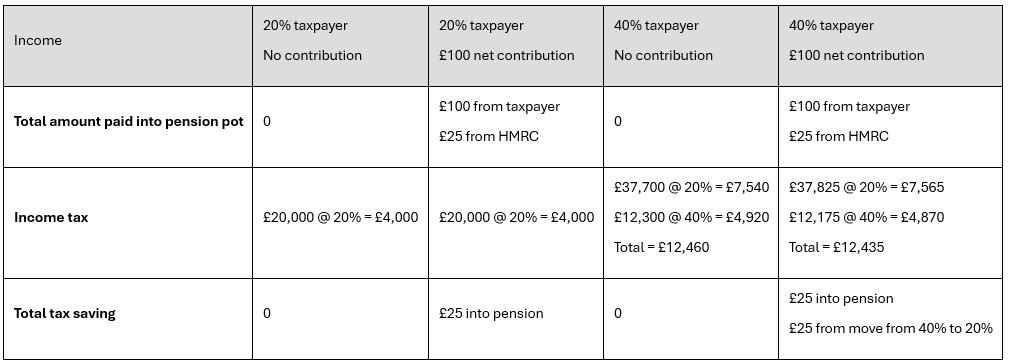

What this means in practice is that tax relief which is reasonably valuable to a basic rate taxpayer is twice as valuable to a higher rate taxpayer.

Someone who has £20,000 taxable income for the year making that pension contribution has saved £25, but someone who has £50,000 taxable income for the year making the same contribution has saved £50. Why? Because they now have more of their income falling into the 20% tax bracket. Remember that, in effect, 40% tax has already been taken from the money that they used to pay into the pension pot. HMRC needs to do two things: bring that money into the 20% bracket and pay the 20% basic rate deduction into the pot.

How does this work?

Income tax comparison between a 20% taxpayer and a 40% taxpayer where each pays £100 into their pension pot

Back to tax relief in general. The point, as I say, is that reliefs work better for those who have tax to save. Rarely in the tax code does HMRC seek to pay money out to someone who never paid it in in the first place.

It is useful to think of tax as a charge on movements of money or value. Dividends are movements of money to shareholders; capital gains are movements of value which make a profit; an inheritance is the movement of value from a deceased estate to its beneficiaries. Tax relief, therefore, can be seen as a way of easing these movements of money or value. Indeed, even the tax relief on working from home, with loosened restrictions during the pandemic, was payable because of the anticipated increase in costs such as energy bills.

The stand-out feature of the current economic situation – rising inflation and food prices, rising interest rates affecting borrowing such as mortgages – is that the cost of living is rapidly increasing for people of all income brackets bar the very, very richest. The issue for most is to find ways of keeping more money in one’s pocket in the immediate term; financial and tax planning beyond the current crisis is some way down the list of priorities.

Final thoughts

So, if tax relief is a relief on money movements, and people seek to make fewer movements, then it is not surprising that there are fewer ways to save tax. And, let’s face it, it would be a brave person to recommend that people save money by putting less in their pension or giving less to charity (and, in any case, I personally would prefer to keep my pension contributions at the same level unless I absolutely had to reduce them, and charities need all the help they can get right now given that, for instance, the number of people using food banks is rising).

As investment tax specialists, we deal with wealthy clients with holdings ranging from UK authorised unit trusts to offshore funds to bespoke structured products. Tax savings are typically made by ensuring debt instruments are gilts or qualifying corporate bonds, ensuring offshore fund investments are reporting and not non-reporting, and generally aiming for capital returns rather than income returns. So, I would never pretend to be a money saving expert – I’ll leave that to the real deal. Nor would I pretend to be an expert on taxes for those on low incomes – there are excellent resources out there. There are various tax reliefs available but all depend on your individual circumstances. All are worth checking out for ways to ensure you aren’t spending more than you need to, in tax or life.