NEWS & VIEWS

Tax Talk is a regular series written by FSL’s tax expert, Alex Ranahan. Alex has nearly ten years’ experience as a tax adviser and analyst. He is accredited by The Association of Taxation Technicians. Alex’s Tax Talks are on general topics and are not tax or financial advice. If you are unsure of the tax treatment of a transaction, we encourage you to seek the appropriate tax advice.

Reducing chargeable gains

Recent HMRC figures showed a significant rise in the use of losses in the tax year 2020-21 – a 27% increase to more than £2 billion from the previous year.

Obviously, owing mainly to the COVID-19 pandemic, the figures show not just that losses were made but that they were utilised to reduce chargeable gains. This reveals, on the part of many taxpayers, that at least a degree of tax planning has gone into their arrangements. The key point with losses is that, of course, sometimes a loss does have to be made – an occurrence that not many clients may be overly keen on. The client must know that their investments are falling in value, so why choose that time to sell?

This is when we have to remember that when clients make investment decisions, tax is often far down the list of priorities. Occasionally the investor knows that their investment is a dead duck, so rather than wait any longer for the price to pick up they simply take the hit and move whatever money they can recoup elsewhere. Or, they want to get cash out of their portfolio immediately to spend on something nice. So they extract funds from a poor investment rather than leave a winning investment.

Whatever the reason, the investor has pulled out of a negative position and yielded cash to spend in other ways. Not an ideal scenario, but better than nothing. But add in the fact that the client can use the loss from selling their position to reduce their tax bill, maybe even allow them to extract cash from one of their winning positions without tax consequences, and you have a much better scenario.

So far so favourable. But a point sometimes overlooked by financial advisors is that not all losses are equal.

Not all losses are equal

Take deeply discounted securities, for example. Essentially meaning bonds that guarantee a high profit on redemption, the profit is charged not to Capital Gains Tax but to Income Tax. This is because HMRC sees the investment as having no risk and the end profit being, in effect, interest accrued during the life of the bond that should have been periodically paid out. Those periodic payments would have been taxed as income so the ‘profit’ on redemption should be taxed as income too.

But if the investor is in the unlucky position of making a loss on their deeply discounted security, they have a problem.

For instance, if the security is denominated in a foreign currency, the exchange rate between that currency and the pound could become unfavourable between the date bought and the date redeemed. In this situation, the investor has no recourse. Since 2003, HMRC has not allowed losses on disposals of deeply discounted securities to be offset against other income unless they were bought before the new rules came in. So, the investor gets no relief.

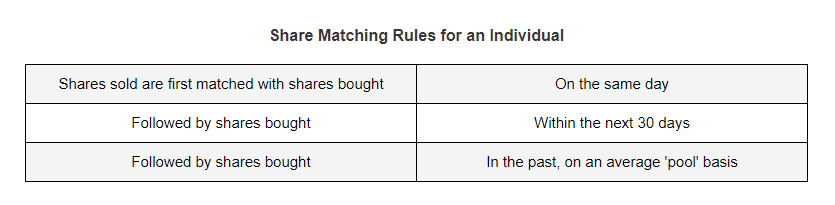

HMRC is often iffy about allowing taxpayers to use financial losses as a reason to pay less tax. It is easy to understand why. It can be easy to abuse, particularly if you are already wealthy and can afford to take a loss in one venture in order to enjoy a now-tax-relieved gain elsewhere. The share matching rules were brought in to stop ‘bed and breakfasting’ where taxpayers would sell shares to realise a profit or loss and immediately buy the same shares back so that they made a gain or loss in the world of tax while retaining an economic asset.

Share matching rules

The matching rules can now mean that an investor makes both a gain and a loss on the same transaction. If the taxpayer sells a large quantity of shares that are performing well, and makes a small purchase of the same shares in the following 30 days when their value has risen further, the rules dictate that we deem the valuable 30-day shares to have been sold first followed by the cheaper historical shares. A loss on the first matched sale and a gain on the second.

This is fine for ordinary shares because both gains and losses come under the rubric of Capital Gains Tax. But in the case of those deeply discounted securities I mentioned earlier where losses are not allowed, or even in the case of offshore non-reporting funds where gains are charged to Income Tax while losses are offset against capital gains, the investor will still end up with a tax liability.

(To those paying attention, yes, deeply discounted securities and non-reporting funds have slightly different matching rules to ordinary shares. The point does not change.)

Financial advisors and relationship managers have difficult jobs and cannot always be across all the details. And, painful though it is for me to admit it, tax is not necessarily the most important consideration when making investment decisions. But it is still important.

How FSL makes things easier

One of the reasons why at FSL we are proud of our new and improved ‘What If’ report is that we can show the tax effect of a client’s disposals and those the client is considering carrying out, so that they can see not just the cash they’ll get out of their position but how it impacts their final taxable income and gains – and any losing positions from which they could still find a benefit.

Most people are not wealthy and many people who make financial losses will never recover them through the tax system. A recent survey commissioned by HMRC found that 14% of people who had ever owned cryptoassets had made an overall loss on them, yet 72% had never seen HMRC’s guidance on the tax treatment. Most of those respondents who had made overall losses reported that their losses were less than £5,000. It seems unlikely that people invested in relatively small amounts and making relatively small losses will ever be able to use those losses like people with larger investments.

I think it is unlikely that the tax system will expand the areas in which losses may be used, but I could be wrong. Still, with inflation rising, belts tightening, and more losses being claimed than ever before, it looks like taxpayers themselves may be wising up to where they can make the tax system work for them.