NEWS & VIEWS

Following the July 2015 Budget we have made the relevant mandatory changes to the CGiX application and data provided. In summary these are:

Change to UK Dividend Taxation:

In the July 2015 budget changes were made to the way UK dividends are to be taxed from 6th April 2016. The budget states that:

The dividend tax credit (which reduces the amount of tax paid on income from shares) will be replaced by a new £5,000 tax-free dividend allowance for all taxpayers from April 2016. Tax rates on dividend income will be increased. The government will set the dividend tax rates at 7.5% for basic rate taxpayers, 32.5% for higher rate taxpayers and 38.1% for additional rate taxpayers.(Finance Bill 2016).

This simpler system will mean that only those with significant dividend income will pay more tax. Investors with modest income from shares will see either a tax cut or no change in the amount of tax they owe.

The clients’ accountant will determine when the new £5,000 tax-free dividend allowance threshold has been reached so UK dividend transactions will be shown in CGiX as gross figures only.

Personal Savings Allowance:

From 6th April 2016 a personal savings allowance of up to £1,000 for basic rate taxpayers and up to £500 for a higher rate taxpayer will be exempt from income tax each year. This means that from 6th April 2016, banks and building societies will stop automatically taking 20% income tax from the interest earned on non-ISA savings.

From 6th April 2016, CGiX income module clients must send through cash interest transactions as Gross payments only, no tax will be applied.

FSL Data Changes:

From 6th April 2016 for UK dividends, for Data model 1 clients, our MasterDB will be populated with a zero tax rate instead of a 10% tax rate. This change will be applied automatically with no requirement for the client to make any changes. Please note that this change will only affect those clients who take our income data as part of their daily data feed (data model 1 clients with Income).

For data model 2 clients dividend transactions must be sent to CGiX with no tax applied.

CGiX Application Changes:

Client Income Report – change to contents but no change to functionality or format.

For transactions dated > 5th April 2016, the requirement is for CGiX not to automatically gross up the expense figure on Capitalisation options, Income Retention and Dividend Reinvestment plans on a UK security, where a 10% tax credit would normally apply, as the payment per share rate on the corporate action will already be the gross rate. The client income report will now populate the gross and net columns with the same calculated figure and the tax credit column will be zero.

There will be no changes to the layout of the client income report and it will not be redesigned due to historic reporting requirements.

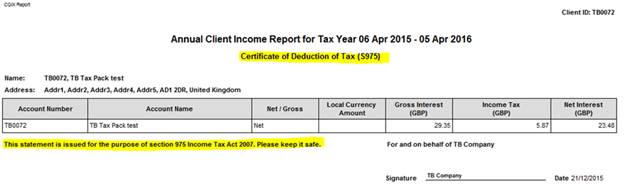

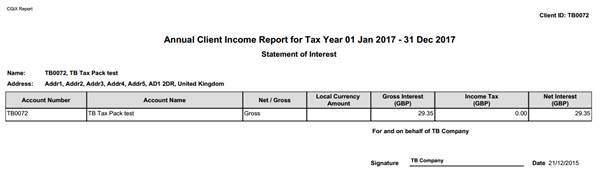

Certificate of Deduction of Tax (S975) / Statement of Interest Report – change to report functionality and menu naming.

CGiX currently produces a Certificate of Deduction of Tax (S975) report via the front end and this can also be included in the Tax pack.

Tax packs produced at 31st December can contain a ‘Statement of Interest’ Report instead of the S975.

CGiX Changes:

1. The front end S975 report selection description will change to ‘Statement of Interest (formerly S975)’.

2. If the end date of the report is after 5th April 2016, CGiX will use the format of the Statement of Interest instead of the Certificate of Deduction of Tax (S975) format to produce the report.

3. If the end date of the report is prior 5th April 2016, continue to produce the S975 report format.

4. The tax pack allocation company profile setting will still have a requirement to include ‘975’, i.e. the report code will not change.

Below is a sample of the reports:

This change will be made available via the usual FSL patch application process for clients – please contact FSLBA&I to arrange delivery of the appropriate level changes.